In today’s economy, where many individuals pursue self-employment and entrepreneurial ventures, establishing financial credibility can be challenging. CPA Letter For Verification of Self Employment is one crucial tool that can assist in this process. This letter, prepared by a Certified Public Accountant (CPA), serves as an official statement that confirms an individual’s self-employed status and provides essential details about their income. Understanding the importance of this document can empower self-employed individuals as they navigate various financial processes.

Introduction

A CPA Letter For Verification of Self Employment is a formal document crafted by a licensed CPA that attests to an individual’s self-employed status. It typically outlines the nature of the business, the duration of self-employment, and often includes an overview of income earned over a specified period. Lenders, landlords, and other entities may require this letter to assess the financial stability and reliability of self-employed individuals, especially when applying for loans, leases, or other financial opportunities.

This letter acts as a professional endorsement of the individual’s financial claims, providing assurance that the information presented is accurate and trustworthy. Given that traditional income verification methods, such as W-2 forms, are often unavailable for self-employed individuals, a CPA letter becomes an indispensable document.

Why is a CPA Letter Important?

The significance of a CPA letter for verification of self-employment cannot be overstated. For self-employed individuals, securing loans, rental agreements, or even contracts often hinges on their ability to prove their income and financial stability. A CPA letter not only validates their income claims but also enhances their credibility in the eyes of lenders and other parties.

Moreover, the letter provides a level of assurance that can differentiate self-employed individuals from those who may not have formal financial documentation. This is particularly important in situations where a borrower’s income may fluctuate or vary significantly. By providing a comprehensive overview of financial history, the CPA letter mitigates concerns lenders might have regarding income consistency.

Process for obtaining

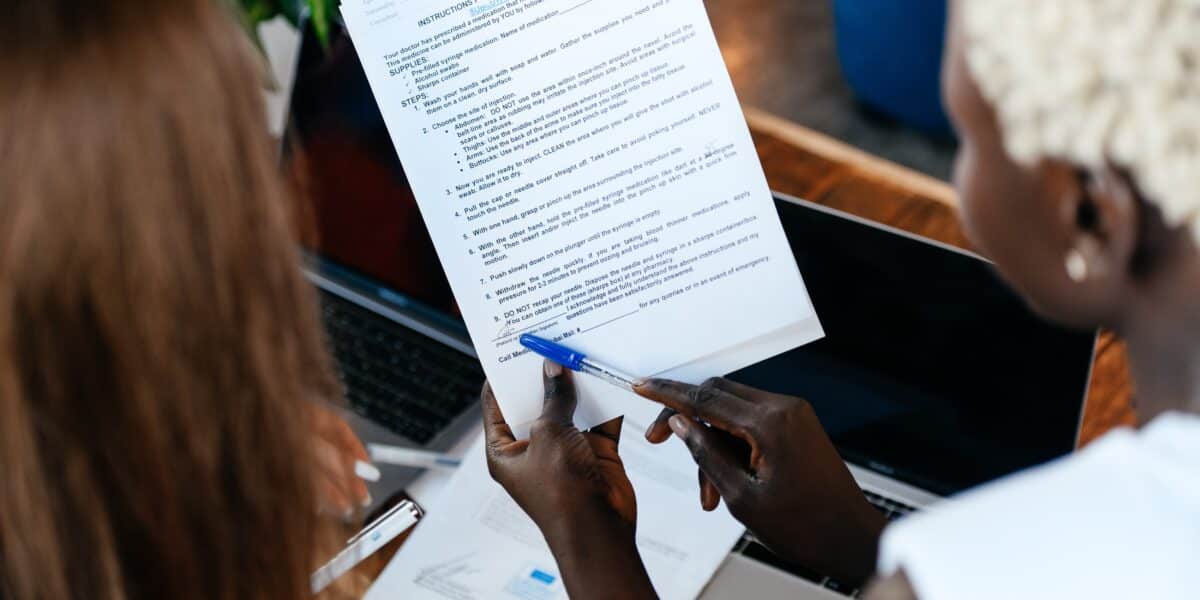

Acquiring a CPA letter for verification of self-employment involves a systematic approach. The first step is to choose a qualified CPA who has experience working with self-employed clients. It’s crucial to find a professional who understands the nuances of your business and can accurately represent your financial situation.

After selecting a CPA, schedule an appointment to discuss your needs. During this meeting, be prepared to provide documentation that supports your self-employment status. This may include tax returns, profit and loss statements, bank statements, and other relevant financial records. The more information your CPA has, the better they can assess your financial situation and prepare a comprehensive letter.

During your consultation, clearly communicate the purpose of the letter and any specific requirements from potential lenders or other entities. This ensures that the CPA tailors the letter to meet these needs effectively. Once the letter is drafted, it should be printed on official letterhead, including the CPA’s qualifications and contact information, to lend it authenticity.

Key Elements of a CPA Letter

A well-structured CPA letter for the verification of self-employment should include several key components. It must clearly state the CPA’s credentials, including their license number and a brief overview of their professional background. The letter should also detail the nature of your self-employment, including the type of business and its duration.

Furthermore, the letter should provide specific financial information, such as your gross income, net income, and any relevant trends over a specified period. This financial data gives lenders a clearer picture of your financial stability and helps address any concerns they may have. Lastly, the letter should conclude with the CPA’s signature and contact information, enabling lenders to follow up with any questions or clarifications.

Frequently Asked Questions

How much does a CPA letter for verification of self-employment cost?

The cost of obtaining a CPA letter can vary based on the CPA’s rates and the complexity of your financial situation. Generally, you can expect to pay between $150 and $500 for this service.

Can I use the same CPA letter for multiple purposes?

Yes, you can use the same CPA letter for multiple applications, such as loans or rental agreements, as long as it accurately reflects your current financial situation. However, some lenders may require an updated letter, so it’s essential to check their specific requirements.

What if my income fluctuates?

If your income fluctuates, it’s important to have your CPA address this in the letter. They can provide context regarding your earnings, showcasing trends that demonstrate your overall financial reliability despite variations.

Conclusion

In conclusion, a CPA Letter For Verification of Self Employment is an invaluable asset for self-employed individuals. This document not only verifies your income and self-employed status but also enhances your credibility in the eyes of lenders and other entities. By understanding how to obtain and effectively use this letter, you can navigate the complexities of financial transactions with greater confidence. Investing in a well-prepared CPA letter can open doors to opportunities, ensuring that you are well-equipped to present your financial case to potential lenders and partners.